The Inflation Saga: Are Rate Hikes Working?

March 2023

12-MONTHS AFTER THE FIRST HIKE, THE ECONOMY IS SENDING MIXED SIGNALS…

COVID presented several challenges to the Canadian business environment, but the after-effects of inflation are still very real. Over the past 12-months, the Bank of Canada (BoC) has raised its key rate from 0.25% to 4.50% to battle persistent inflationary forces. The larger theme that the BoC appears to be communicating is that Canadians should expect rates that are ‘higher-for-longer’ to provide the economy some time to cool off. Based on this guidance, there should be three questions on the minds of business owner and lenders alike:

have rate hikes had the impact they were intended to,

how much higher can rates go, and

how does this impact me and my business?

In this Debt Digest, we aim to provide some guidance on these questions. Read on to find out more.

THE BACKUP DATA

Inflation Has Come Down, But Persists: Inflation has come off its June 2022 high (8.1%), but still remains well above the BoC 2% target. Food (10.4%), Shelter (6.6%) and Healthcare/Personal Costs (6.2%) continue to remain elevated. The January 2023 inflation report was the first month showing a meaningful decline in other inflationary measures, including CPI-measures. This will be a key trend to monitor going forward.

Canadian CPI Measures, Jan 2019 - Jan 2023

OUR THOUGHTS

There are early indications that the BoC’s rate hikes have systematically decreased some demand elements in the Canadian economy, however there is still work to be done. Most notably, consumer spending continues to remain strong with Canadian’s spending more on necessity items, such as food and shelter (the cost of which remains elevated). Going forward, business owners and lenders should adopt the BoC’s message of ‘higher-for-longer’ and prepare accordingly. Whether that means re-structuring certain elements of your business, re-financing debt, or finding other solutions to capital problems, DWA’s expertise and network has assisted business owners across Canada. We will continue to monitor the impacts of rate hikes, and will provide an update in a future Digest.

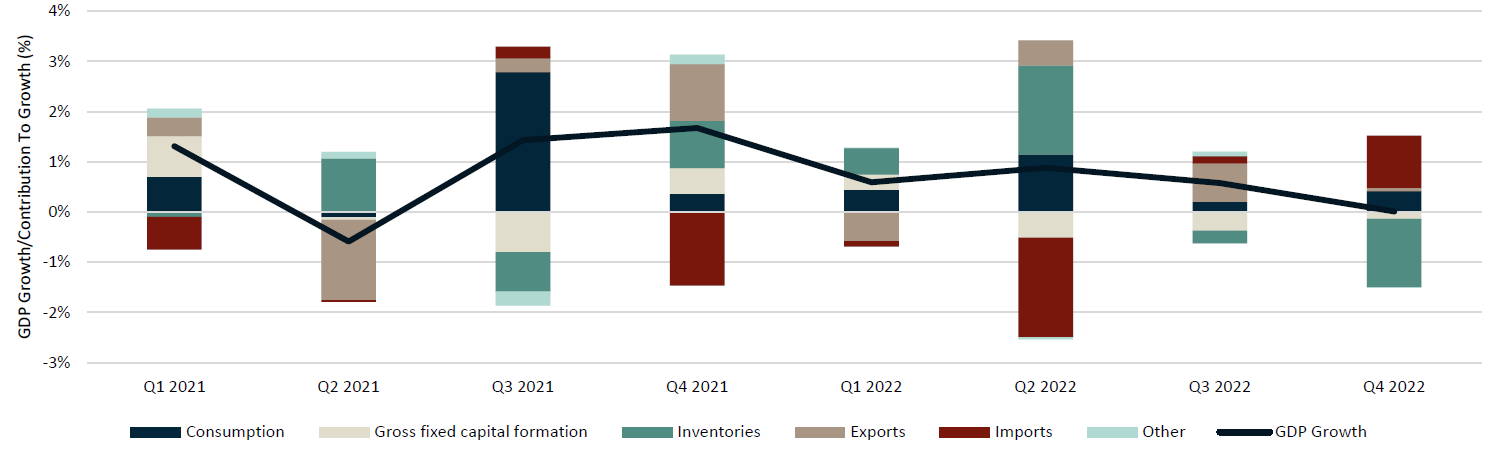

Canadian GDP Growth/Component Contribution, Quarterly (Q1 2021 - 2022 Q4)

FLAT GDP GROWTH SUGGEST RATE HIKES ARE WORKING.

Since the beginning of the rate hike cycle in March 2022, Canadian GDP has steadily declined and has now reached 0% Q/Q growth as of Q4 2022. This is a good indicator that the BoC’s actions have been successful at systematically decreasing demand in the Canadian economy, which has also had impacts on reducing inflationary forces. Certain elements of the economy remain particularly strong, namely consumer consumption which contributed 0.3% to Canadian GDP growth in Q4 2022. Other notable factors include government spending (0.1%), capital formation (-0.1%), inventories (-1.4%) and imports (1%). Aggregate inventories (including business, non-farm and farm) had a steep mark-down during Q4 2022, while it appears that Canadians are importing noticeably less goods. We will continue to monitor this, however it does appear the BoC is moving the dial in the right direction.

ECONOMIC MEASURE: Consumer Spending (Quarterly, Q1 2019 - 2022 Q4)

Canadian Retail Sales

Components of Canadian Retail Sales

CONSUMER SPENDING REMAINS STRONG…

Consumer demand, as measured by retail sales, continues to grow (+1.1% Q/Q, +6.2% Y/Y) suggesting that the BoC’s rate hikes are not having their intended impact on this piece of the Canadian economy. While luxury expenses, such as spending at restaurants, has been elevated (+7.1% YoY), Canadians appear to be spending quite a bit more on the necessities. Food (+8.4% YoY), Housing (+8.5% YoY), Health (+9.5% YoY) and Transportation (+15% YoY) continue to compose approximately 62% of Canadian household expenditures, showcasing Canadian’s sensitivity to these areas. Food and housing inflation, which haven’t made as much downward progress when compared with other elements of inflation, could continue to be a major battle the BoC will have fight through 2023. We will continue to monitor these trends.

ECONOMIC MEASURE: The Labour Market (Monthly, Oct 2020 - Dec 2022)

Labour Market Indicators

Canadian Job Vacancies

THE LABOUR MARKET STAYS HISTORICALLY TIGHT

Over 2022, a total of 446,700 FT jobs were added to the Canadian economy with a majority of the gains being attributed to labour force growth (49% of jobs) and re-employment (43%). The overall labour market continues to remain historically tight with the unemployment rate at sub-5% and job vacancies being 64% above their pre-COVID historical average (~754,000 job vacancies vs. 459,000 historical average). However, there are early indications that the labour market is responding to the BoC rate hiking cycle. The employment-to-job vacancy ratio has pivoted since hikes were initiated, and job vacancies are currently in a declining trend. We will continue to monitor these trends as the BoC’s rate hikes continue to impact the economy.

ECONOMIC MEASURE: Canadian Business Investment (Annually, 2019 - 2023F)

CAPEX / BUSINESS INVESTMENT REMAINS ELEVATED BUT ARE FORECASTED TO SLOW IN 2023

Aggregate Canadian CAPEX spending continued to grow aggressively in 2022 (+11.6% Y/Y vs. ~3.8% Y/Y historically), with the largest increase being attributed to mining, quarrying and oil and gas (+24% Y/Y, composes ~15% of Canadian CAPEX). With rising rates, this trend is not expected to continue in 2023. The BoC is currently forecasting a noticeably slower growth rate compared to the post-COVID era (+4.3% forecast vs. +11% post-COVID) due to their rate hikes. We will monitor this trend through 2023 to see if the BoC’s forecast proves to be true.

ECONOMIC MEASURE: OTHER ECONOMIC INDICATORS

Housing: Activity and prices across Canada have quickly responded to the BoC’s rate hikes. According to the Canadian Real Estate Association, housing prices have fallen 9.3% and home sales activity has fallen 42%.

Supply Chain: The FreightosBaltic Index has shown that the price in major shipping lanes has decreased approximately 72% since global rate hikes began.

Equity Markets vs. Fixed Income Markets: Markets have been choppy; Canadian equities are down 5.4% and Canadian fixed income is down 6.5% since rate hike were initiated in March 2022. Commodities provided some cushion when compared to the US.

Commodity Markets: Overall commodity markets have declined by 30% since rate hikes began, however remain 23% above their historical average. Much of this volatility was likely due to the war in Ukraine prior to rate hikes.

Sources: Statistics Canada, Bank of Canada, Diamond Willow Advisory, Canadian Real Estate Association, Freightos.