Debt Funding for Canadian Small Business

October 2020

IN THIS ISSUE:

Roughly one-third of small businesses in Canada seek a form of external financing on an annual basis with debt making up roughly 85% of those funding requests.

We dig into the historical loan approval rates and compare it to the amount funded vs. the amount requested. This reinforces how the credit market has favoured borrowers over the last 5 years.

Canadian small business lending index suggests the credit market is loosening up after the tightening seen in May of this year. Access to debt is still difficult for certain sectors.

A LOOK AT SMALL BUSINESS DEBT FUNDING IN CANADA

We like to think about the financing of a business along the lines of gasoline for your car (this isn’t a stretch, we promise). With the right fuel and enough of it, your business can propel forward. But putting the wrong fuel in or letting the needle drift to empty and everything comes to a screeching halt. Access to capital and the correct form of capital are key to keeping Canada’s 1.2 million small and medium businesses rolling forward. This month we wade into the world of small business funding, the particular role of access to debt and how indications suggest access to credit has become significantly easier than it was just four months ago (depending on the sector).

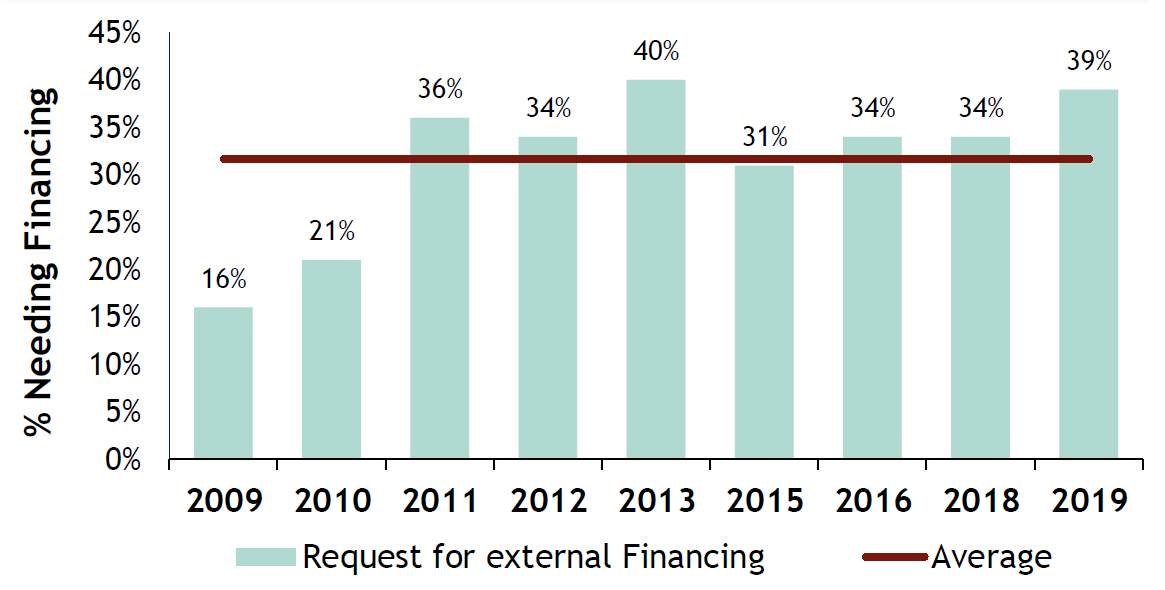

The historical average suggests 32% of Canadian small and medium businesses seek some form or external capital on an annual basis. 2019 numbers pegged this data point at 39% and despite not having 2020 data, it’s not a stretch to think this number will be significantly higher. What this means is nearly 400,000 Canadian businesses looked for external capital in 2019 – of these, 85% were seeking some form of debt capital (non-residential mortgage, term loan, credit cards, etc.).

Canadian Small Businesses Seeking External Funding

SHIFTING SANDS OF THE BORROWING LANDSCAPE

A topic we have extensively discussed is how the economic headwinds have flipped the credit market from a borrowers market to a lenders market. Despite historically only making up ~15% of new capital loaned to Canadian businesses, private, non-bank lenders are going to be playing an increasing role in the short to medium term. Our concern falls on small loans (call it below $0.5 million) as the number of non-bank lenders supporting loans of this size is quite limited, which will potentially limit access to capital for businesses requiring loans of this size.

SMALL BUSINESS BORROWING MARKET HAS BEEN VERY FAVOURABLE

When looking at the approval rate for small business borrowing requests, its clear that access to debt capital has been relatively easy over the past five years with the 2019 loan approval (i.e. willing to fund at least a portion of the loan request) rate just shy of 90%. The last time we saw an approval rate below 80% was in 2009 as we were coming out of the financial crisis.

Over the past five years the ask versus funded amount (how much businesses get versus the requested amount) has averaged 90%, (2009 dipped to 72% as lending institutions were conservative coming out of the financial crisis). Working capital is the most popular use of proceeds as we have seen a steady decrease in proceeds going to fixed asset purchases.

Loan Approval Rates and Funded %

Use of Loan Proceeds

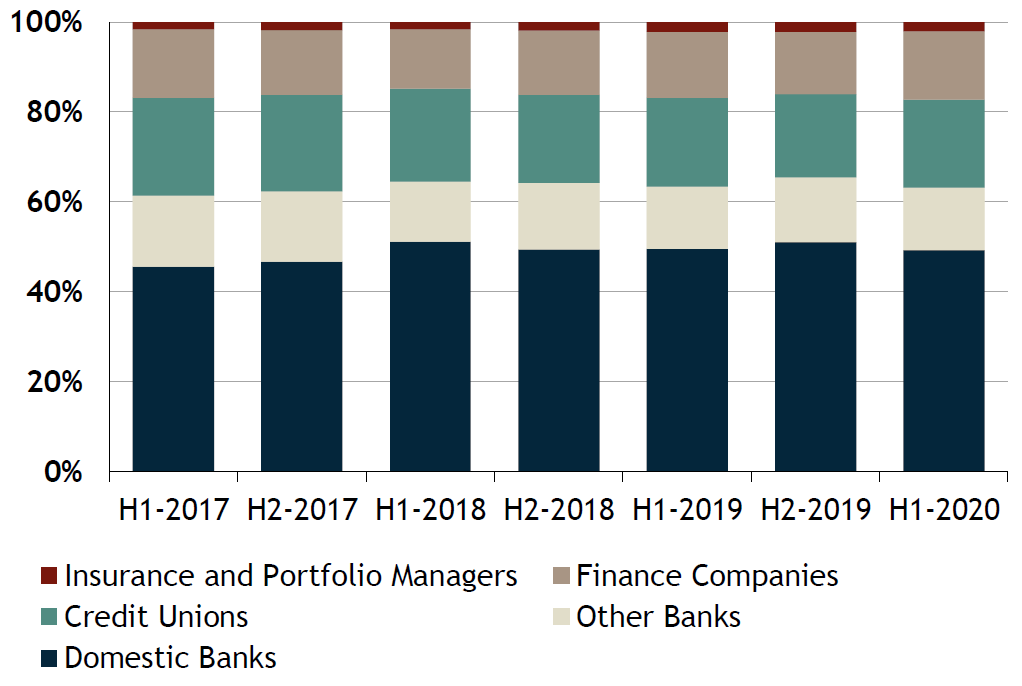

BREAKDOWN OF FUNDING REQUESTS BY SIZE AND SUPPLIER

At roughly 60%, small loans (less than $250,000), dominate the number of new loans in a given reporting period as loans above $1 million make up only 30% of the total proportion. Historically, nearly 90% of loans below $250,000 are executed at banks and credit unions. When looking at larger loan sizes we typically see non-bank lenders playing a greater role.

Proportion of loan sizes (H1-2020)

Funding Breakdown for Loans between $1mm-$5mm

HAVE WE TURNED THE CORNER?

Based on the Paynet – Canadian Small Business Lending Index (CSBLI), we did see a bottoming out of lender’s willingness to put new money to work in May of this year, but we have subsequently seen a significant bounce back. While it is important to note this lending index is a measure of the number of new loans (it does not account for structure of those loans), the number of new loans in August matched the peak seen in early 2015. We do think part of the bounce back relates to pent-up demand and suspect we see a downward trajectory for the coming months of data.

Deferral programs from Canadian banks are generally winding down. For those owner occupied business in need of capital, realizing on the equity in their building is a good source of capital.

Paynet - Canadian Small Busines Lending Index (CSBLI)

LENDING APPETITE DEPENDS ON THE SECTOR

Digging further into the Paynet lending index, we drilled down into the lending appetite for some of Canada’s top small business sectors. Results are not overly surprising but they do reinforce the fact that some sectors are going to recover from the economic headwinds brought on by the pandemic faster than others.

When looking at recent lending trends, agriculture has seen a recent jump in loan demands being funded, while construction projects have enjoyed a steady increase. When thinking about those sectors facing the largest headwinds, it’s not surprising to see the retail and accommodation sectors continue to have a tough time getting loans funded.

Small Business Lending Index - Relative Number of Loans by Key Sector

Sources: Government of Canada, Diamond Willow Advisory, Paynet.